Glencore’s watershed moment – the beginning of the end for commodities companies?

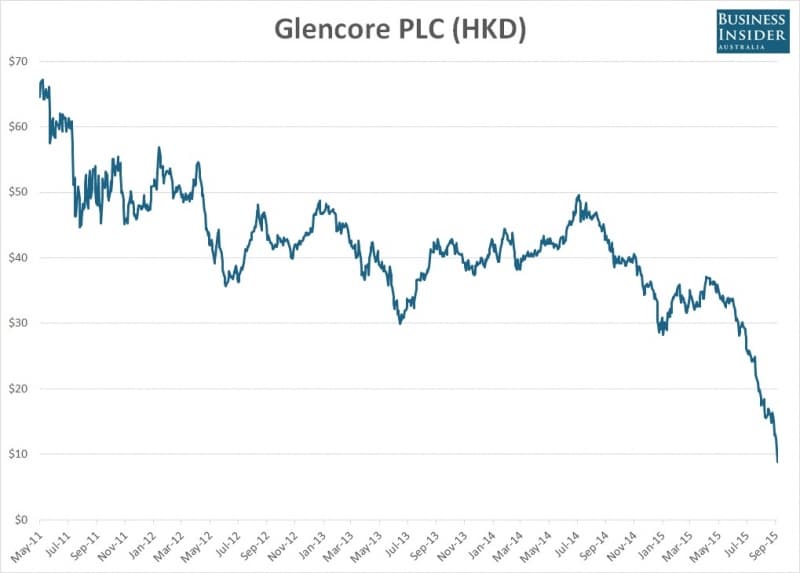

Some have called it the resource industry’s “Lehman Brothers” moment. The Australian share market shed a whopping $56 billion in one day last week – and the crash was led by mining and trading company Glencore. The company had been struggling with a net debt of nearly thirty billion dollars after taking over coal mining company Xstrata in 2013, as Chinese demand slows and commodity prices decline. The calamity has cast doubt over the viability of fossil fuels, with Bank of England Mark Carney warning investors face “potentially huge” losses from climate change action that could make vast reserves of oil, coal and gas “literally unburnable” – all just in time for global climate talks in Paris next month. We find out how the crash is set to affect the energy landscape.

Featured in story:

- Marina Lou, legal advisor, Greenpeace

- Giles Parkinson, editor, Renew Economy